Kids, you can’t stay on your parents’ insurance plan forever.

But, according to the Affordable Care Act, you can stay on it until you’re 26… which gives you long enough to get educated on how to obtain your own health coverage.

Purchasing a health insurance plan will give you protection against financial debt, in case of an injury or sudden illness.

Not to mention it will give your parents peace of mind!

Having your own health insurance can also be a milestone in gaining more responsibility and independence.

So, how do you find out about insurance plans? You don’t need to be an expert on this stuff in order to get coverage, leave that to us at Nevada Benefits.

How long can children stay on parents’ insurance?

As we mentioned above, you can stay on your parents’ health insurance until your 26 years old.

While this answer seems easy, there are a lot of other things both children and parents need to think about during the transition.

Does it depend on the state? Is Nevada any different?

No, the law remains the same in every state.

The federal government mandates that health insurance carriers who offer coverage to adults and dependents must allow dependents to stay on their parents’ plans until they are 26 years old.

More good news.

This law remains the same even if you are:

- Married

- Not living with your parents

- Attending school

- Not financially dependent on your parents

- Eligible to enroll in your employer’s plan

When you turn 26, does that count as a “qualifying event?”

What Is a Qualifying Event?

Unfortunately, you can’t enroll in health insurance at any time.

If you miss the yearly window for open enrollment, you will need to qualify for a special enrollment period.

This is where QLE’s come in.

These are changes in circumstances that make you eligible to sign up for new health insurance outside of open enrollment.

Some examples of Qualifying Life Events are:

- Loss of health coverage

- Changes in household (like a new baby or getting married)

- Changes in residence

- Other – having to do with military enrollment and becoming a U.S. Citizen

There are time limits to the special enrollment period after having a qualifying life event.

Be sure to contact a Health Professional at Nevada Benefits as soon as possible so you don’t miss your special enrollment window.

What Is Open Enrollment?

Open Enrollment is a period of time, once per calendar year, when everyone qualifies to change their health insurance plan. It lasts for a month and a half in November and December. This is the time period you have to cancel or purchase your coverage.

After you make the necessary changes to your plan, the changes don’t go into effect until January 1.

Open enrollment is a date you should be tracking in your calendar.

Since you won’t always have a QLE that qualifies you for a special enrollment period, you will need to have your health plan options selected by the open enrollment time.

Evaluate your options ahead of time.

You can decide – have your medical, dental or vision benefit needs changed? If so, you might want to increase or decrease your coverage in these areas.

Are you happy with the in-network doctors and hospitals that you have been seeing? If you want to switch your doctor, there should be other options under your current insurance. If you find they offer too few options for different providers, you may consider a change.

Open enrollment time periods can be overwhelming.

Make sure you enlist the help of our staff at Nevada Benefits to get the most up-to-date information about what plans you qualify for.

So, Does Turning 26 Count As A Qualifying Event?

Yes!

When you turn 26 years old, and have technically lost your health insurance, you can use this as a qualifying life event (QLE) to be eligible for enrollment in a new insurance plan.

This is important because it means you won’t have a gap in coverage.

A gap in coverage means that if you get sick, you could incur significant medical bills.

Once Off Your Parents’ Insurance, What Should You Do?

“I turned 26 and I’m off my parents’ insurance! What do I do now?!”

Don’t worry.

Nevada Benefits offers many options for health insurance coverage that will work for your personal and financial needs.

You may be wondering, “what type of insurance should I get?”

Insurance benefits and costs vary based on what you require.

If you’re in very good health, you can purchase a simple, low-cost catastrophic insurance that will put your parents’ mind at ease. In the case of major injury or illness, your family will be protected from big financial burdens and bankruptcy.

Having more benefits included in your plan will ensure that you can go to your favorite doctors, and stay in great health by getting the most of check-ups and vaccines.

The best thing to do when you’re approaching your 26th birthday is to get educated about your health insurance options.

Once you find out what benefits are available, you can decide how much you’re willing to pay for the coverage you require.

Can you get insurance through work?

Plans that are offered through your employer can help pay for some of your health costs, but they aren’t always the most affordable option.

There may be a lack of choices in your employer-sponsored insurance, and they may not support your dependents.

They don’t always include benefits like vision or dental, which Nevada Benefit can provide as supplemental insurance.

Always shop around before committing to an insurance provider. This will help you to get the most out of your plan. Speak to one of our specialists to better understand what you qualify for under your employer’s plan, and if it will be enough to keep all your bases covered.

Will you qualify for Medicaid or will you need to go through Obamacare?

A very common question when shopping for insurance is, “Do I qualify for Medicaid?”

The answer to this question firstly depends on your state of residence.

According to the State of Nevada, to qualify for Medicaid, you must meet the following criteria:

- Resident of Nevada

- U.S. national, citizen, permanent resident, or legal alien

- Be in need of health care/insurance assistance

- Be in a financial situation that is characterized as low or very low income

They also take into account if you are:

- Pregnant

- A caretaker of a dependent child under age 19

- Blind

- Have a disability or caring for someone with a disability in your household

- 65 years of age or older.

Specifically, in Nevada, if you have an annual income of up to 138% of the federal poverty level, you may qualify for Medicaid.

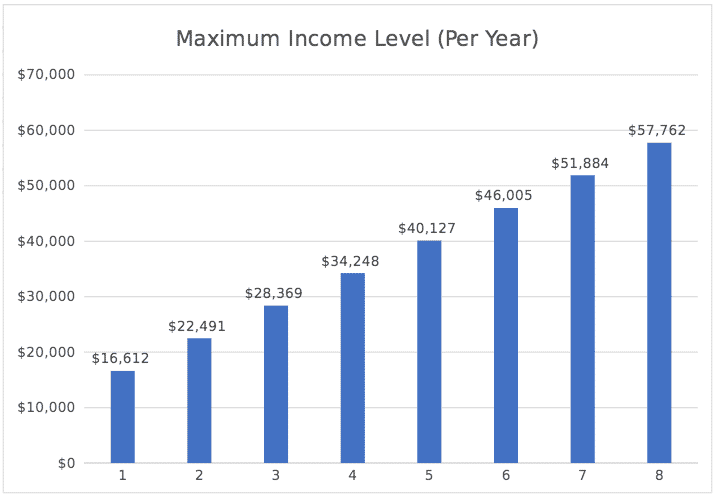

This means, if you are an individual who makes less than $16,612 per year and has no dependents, you could qualify. When you start including other family members incomes in the same household, the numbers change.

Here is a handy chart with the maximum income level per year to qualify:

At Nevada Benefits, we can help you determine if you qualify for Medicaid and how that process works.

What type of insurance will be best for you?

To find out what coverage to buy, you have to ask yourself, “what type of insurance do I need?”

This depends on many factors.

How many times are you planning on visiting the doctor each year for routine visits?

Do you want unlimited access to different doctors and specialists, or would you rather have a lower premium and be limited to in-network providers?

Would you rather pay at the time of service, or part of your monthly premium?

Do you only need coverage for major expenses like emergency room visits?

Here are several plan types that are offered:

Exclusive Provider Organization (EPO):

An EPO is a care plan that requires you to see in-network providers. Services will only be covered if you see the doctors, specialists and hospitals in the network.

Health Maintenance Organization (HMO):

An HMO plan limits coverage to care from doctors who work for or contract with the HMO. You may be required to live or work in the service area of the HMO.

Point of Service (POS):

With a POS, you will pay less if you see providers in-network. You may be required to get a referral from your primary care doctor to see any specialists.

Preferred Provider Organization (PPO):

If you have a PPO plan, you will pay less to use in-network providers, but you can use doctors outside of the network without a referral for an additional cost.To learn more about specific plans and network types, reach out to us at Nevada Benefits or visit How to Pick the Best Insurance Plan.