Finding the right health insurance policy for you and your family can already feel like a challenge.

It is not uncommon for you to search for the best coverage with low deductibles and lowest premiums possible. With so many health insurance plans and options to choose from you may have stumbled on a few that seemed to be such a great deal you couldn’t pass on.

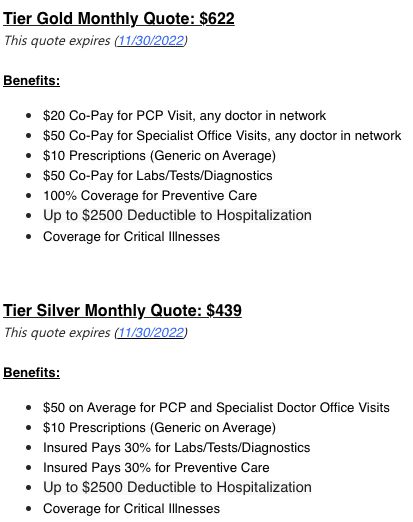

Our friend Joseph was one of those people who didn’t pass up on the opportunity and decided to look more into the MultiPlan coverage. Joseph is a 52-year-old non-smoking male, looking for individual coverage for just himself. Upon looking more into these enticing deals, this is what was offered to Joseph:

- You get to choose any doctor within the PPO network.

- MultiPlan’s Limited Benefit Network gives you discounted access to qualified doctors, healthcare facilities, labs, imaging centers, and hospitals at no additional charge.

- MultiPlans are one of the oldest and largest healthcare networks in the U.S. Currently, MultiPlan contracts with over 770,000 respected practitioners, 5,000 hospitals, and 70,000 ancillary care facilities.

- MultiPlans make it easier than ever to find a participating healthcare provider in your area. You save an average of 20-30% off inpatient and outpatient hospital charges when you use the MultiPlan Network.

As that may look like the coverage you want, Joseph quickly learned it was not the coverage he needed or deserved, Joseph was sent the following coverage breakdown:

The above cost breakdown was sent with a message stating;

“There is a one-time non-refundable application fee ($30 on average) for this plan. Payment information is required with application due to application fee.”

This fee is mandatory before you can even be told if you qualify and which carrier you will have health insurance with.

After asking why can’t they begin the application process or have the autonomy to choose the carrier, Joseph was told

“Upon submission of the enrollment form, the underwriting will do a pre-qualification assessment of your information. You will then receive a pre-approval email stating the insurance company that will handle the plan and your policy number. From there, you can decide if you want to move forward or not.”

As we continue to warn others about these types of plans and the truths about the coverage. Here are the top 5 complaints on BBB concerning MultiPlans:

- False Product Claims

- Hidden Terms

- Hidden Fees

- Uncovered Claims

- Limited to No health care coverage

If you are a victim of a Multiplan or would like to review your current plan to find out if it is a Multiplan, we offer complimentary plan reviews to customers.

Call us now at (702) 258-1995 or schedule an appointment to review and shop healthcare options: https://calendly.com/d/d7p-3hb-qx6/2023-open-enrollment/