Health insurance can be ridiculously confusing.

It can feel like navigating the Amazon rainforest without a map. And without water.

There are so many technical things like Open Enrollment, deductibles, filing claims, on-exhange vs off-exchange… And the Special Enrollment Period.

This guide will walk you through what the Special Enrollment Period is, how it works, and if you qualify for it.

What is Special Enrollment Period?

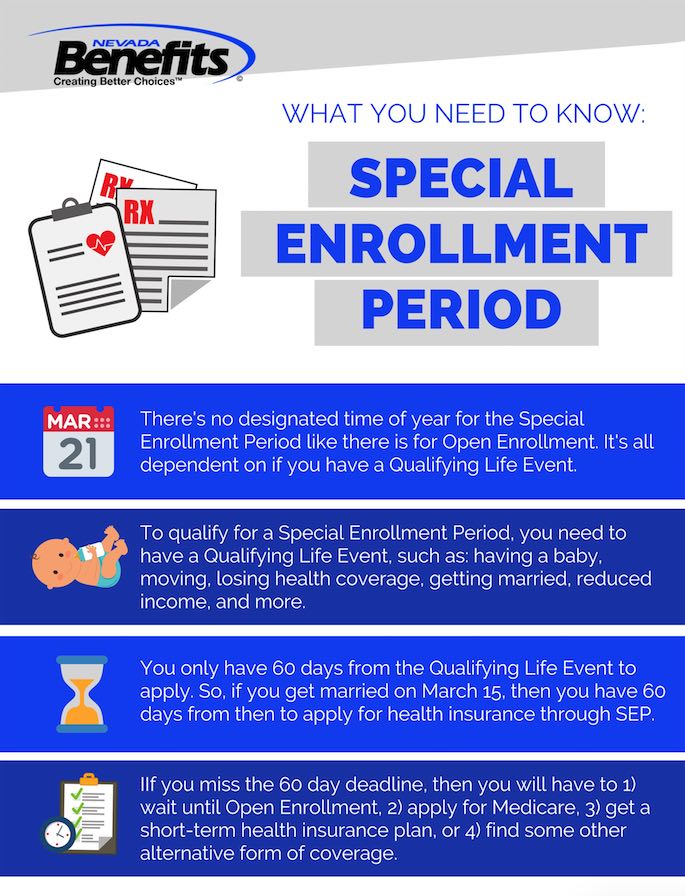

Do you know when you miss the opportunity to sign up for health insurance during Open Enrollment Period, you might have to wait until the next Open Enrollment Period?

However, there is a Special Enrollment Period. Special Enrollment Period is a time outside yearly Open Enrollment Period where you can acquire health insurance ONLY if you had a QUALIFYING EVENT.

Bear in mind, you are granted up to 60 days if qualified for SEP. Otherwise you would have to wait for the next OEP.

What Is A Qualifying Event For Special Enrollment?

A qualifying event for Special Enrollment is simply a life circumstance that may affect your health insurance requisites or your qualification for current health insurance plans.

According to HealthCare.gov, there are 4 basic types of qualifying life event. They include losing job-based health coverage, job loss or job change.

We’ll go through those first. Then we’ll cover some other qualifying life events unrelated to employment.

NOTE: If you have any questions or inquiries about qualifying events for the Special Enrollment Period, speak to one of our professional health insurance consultants.

Qualifying Event 1: Job change within the same company

This includes any sort of promotion, transfer or demotion. If you have not yet been covered following your job status change, you may qualify for SEP.

Qualifying Event 2: Loss of full-time status at work

Loss of full-time status due to factors outside your control or involuntary elements makes you eligible for SEP.

Qualifying Event 3: Part-time to full time

Converting from part-time to full-time job status is a QLE. The new coverage will run from the date of official termination of the old coverage.

Qualifying Event 4: Retirement (with no health coverage from former employer)

Coverage for this case will stop at the end of the month. You can apply for

Medicare, COBRA or in a Marketplace or own health insurance plan.

Qualifying Event 5: Return from military leave

You can change your health insurance plan. Your spouse, dependants and yourself are eligible for health coverage.

Qualifying Event 6: Getting married or divorced

You are eligible for a Special Enrollment Period if you get married or divorced.

Qualifying Event 7: Having a child or adopting a child

If you have a child or adopt a child, that is considered a qualifying life event. And, when this happens, you are eligible for the SEP.

Qualifying Event 8: A death in your family

If a family member dies, you may qualify for Special Enrollment. It depends on the type of family member – if a cousin or uncle passes away, you probably won’t qualify. If a spouse or child passes away, then you will likely qualify.

Qualifying Event 9: A change in your residence

If you move to a different state, county, or even zip code, you are likely to qualify for the Special Enrollment Period. There are other types of “moves” that may qualify:

- A young adult moving to a different state to attend college

- A seasonal worker moving to a different state for a short period of time

- Moving to transitional housing if you’re homeless or living in temporary housing

Qualifying Event 10: Loss of health coverage

If you lose health coverage (involuntary) then you qualify for a SEP.

This includes things like:

- Losing your job and losing health coverage

- Turning 26 and no longer being eligible to stay on your parents’ health insurance policy

- Losing eligibility for Medicaid, Medicare, or CHIP

Qualifying Event 11: Other life qualifying events

There are some other life qualifying events that don’t fall under any particular category.

Things like:

- Gaining membership to a Native American tribe

- Joining or exiting AmeriCorps

- Becoming a US Citizen

- Being released from incarceration

- And more

Lost Health Insurance – Do I Qualify For Special Enrollment Period?

Is losing health insurance a qualifying life event? Well, fortunately, if you read the section above, being affected with loss of health coverage is a QLE. See HealthCare.gov section about job-based coverage.

A caveat – the loss of health coverage has to be involuntary. If you simply cancelled or stopped paying your premiums, you will be automatically not qualified for Special Enrollment Period.

Missed Special Enrollment Period, Now What?

Let’s say you are granted SEP but after 60 days and no significant action is taken, your window is closed. What do you do? Well, your strategy is either to wait for the next Open Enrollment Period, apply for Medicaid or purchase a short-term health insurance plan.

1. Wait Until Open Enrollment

As of now, Open Enrollment period runs annually from the beginning of November to mid-December.

Nevada’s Open Enrollment for 2020 is November 1st, 2019 to December 15th, 2019.

Check out our guide for Nevada’s 2019 Open Enrollment Guide (applicable for 2020)

2. Apply for Medicaid

Medicaid is an insurance program that caters for individuals of low-income status. It is not only exclusive to those who are of little or no income but some families, pregnant women, the elderly, and people with disabilities also qualify.

You can apply anytime, even if it’s not during Open Enrollment or a Special Enrollment Period. If you qualify, you will immediately gain coverage. Keep in mind, whether you qualify depends on your state’s program because some states have expanded their Medicaid programs and have varying benefits and program names.

If you live in Nevada, you can apply for Medicaid by reaching out to one of our Medicaid specialists.

3. Purchase Short Term Health Insurance

An alternative is to purchase a short-term health insurance plan. Also known as “Term Insurance” or “Temporary Health Insurance“.

The duration of short term health insurance varies, but most last for around 180 days. The plans might differ state by state but in Nevada, the duration is usually around 180 days. If successfully registered, you can gain coverage the day after your application!

Special Enrollment Period Medicare – How Does That Work?

According to Medicare.gov, Medicare is a federal health insurance program for people who are aged 65 and older, younger people with disabilities or individuals with certain diseases. The program encompasses aspects of health care such as hospital, medical insurance and prescription drug coverage depending on the criteria of the insuree.

To be eligible, first you must be a U.S citizen for at least five years and if you have no income or are unemployed, you may qualify for low-income programs that reduces Medicare premium costs. One example is being eligible for Medicare Savings Program (MSP) through Medicaid.

See what is included in Medicare Savings Program.

You can acquire Medicare through a Special Enrollment Period. SEPs work for different parts of Medicare: Part A and B (Original Medicare), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Each has different qualifications. The procedure is similar to applying for general programs through SEP, you just need to find which Medicare part you need the most. Again, visit Medicare.gov website for further information.

If you’d like to apply for Medicare, reach out to one of our Medicare specialists and they can help you get your application completed.

Special Enrollment Period for Group Health Insurance – How Does That Work?

For group health plans, there is indeed a Special Enrollment Period in place (specifically Small Group Special Enrollment Period). Small businesses (between 2 and 5 employees) can benefit from small group health plans.

Basically, if you own a business and have employees on your payroll, you can set up a group plan. Like individual SEP, you still can enroll your group in Group Special Enrollment Period during a one-month period.

This is an interesting position to be in because your business does not have to pay towards premiums and at least one employee needs to be enrolled to establish and validate your group plan.

A great plus for you – there is no requirement of spending any money on health coverage.

If you’re looking for group health insurance, we have licensed agents that can give you a comprehensive list of the cheapest quotes.