We had an opportunity to sit down with our Founder and CEO, Phil Randazzo to ask a few questions about what newlyweds should do when they first get married.

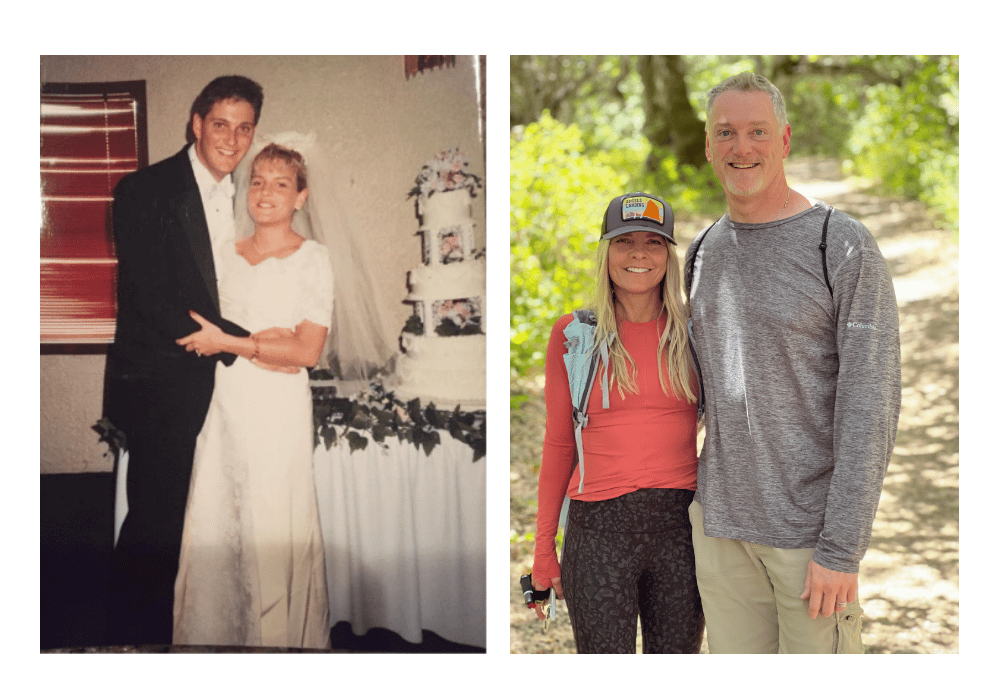

Phil and his beautiful wife Jennifer have been married for 31 years, so Phil has a lot of experience in this arena. Here is what he had to say:

- You may have already done this, but make Sure all financial bases are covered by reviewing all debt, interest rates, and other liabilities. You may have some leverage with a combined credit score to reduce your interest rates.

- Come up with a financial goal and spending budget. Most arguments come from financial disagreements (being married almost 31 years I can agree with the stats on this – ha-ha!)

- Look to see if you still qualify for IRA’s or ROTH IRA’s now that you have combined income.

- Add each other as beneficiaries to each other’s life insurance policies both at work and any personal policies as well as final paychecks

- Update all bank accounts, addresses, and names (beneficiaries as well)

- Compare insurance quotes that will cover both your health, either at your employers or if you each had personal policies. You might find leverage, lower costs, adding your spouse to one of the plans

- Check with employers and see if they offer coverage through your job. See if you can add your spouse. We can help with a side-by-side comparison of the plans for you as well as coverage options.

- Marriage is a qualifying life event; this means you can go on the exchange and purchase a plan with no pre-existing conditions! Start shopping for Health coverage within 60 days of those vows!!

- Get all documents, marriage certificates, updated driver’s license, etc.) in order so you are ready to provide them when applying for health insurance. (A broker can help with that…at no cost to you!)

- You may now need life insurance to cover your spouse or partner. Take a look at what you currently have, look at your debt, children’s needs, mortgage, etc.- you can download this free worksheet to help you calculate your needs here (we have a worksheet, please attach a link here) Take out a life insurance policy and or update any beneficiaries on existing. The cost, if healthy, is much lower than most people think! Link for a free quote here https://agents.ethoslife.com/invite/2fefb

- Enjoy each other! From someone who’s been married as long as I have (to the same person ha-ha! ) Looking back at all the things I thought were so urgent and so bad at the time, I wish I would have been more kind and listened more instead of trying to direct and control all the situations.